Are unicorns really white?

When Ailen Lee used the word “unicorn” in 2013 to describe startups valued at at least $ 1 billion; she had no idea that 9 years later Marta Šimić Mrzlečki, Emil Tedeschi and even FER dean Gledec would preach that as a nation (and in spite of the environment), we are successful in breeding these unattainable breeds.

The narrative goes even deeper because the media, including Netokracija, caught on to the praise, so the number of unicorns began to shine as a medal of the domestic IT scene.

Media buzz prostitution is not new in our industry, but the problem arises when naive stories overwhelm architectural astronauts – a team that fantasizes about grandiose achievements, not caring about the realization or repercussions of their ideas.

Americanizing the business climate, focusing on financial engineering and inflated valuations of startups place unrealistic expectations on founders, distort investors, and consequently divert attention from quality projects or more important topics.

I will break down these issues in this article, but we will not get stuck just on them alone. At the end, I will list a few points for the founders for whom the status of a unicorn should not be the goal, but a possible consequence.

Valuation Gamification

Rivian’s recent IPO showed us that valuations don’t have to have anything to do with profit, history, or number of employees. How else to explain the estimate of 112 billion dollars of a company that has practically no income, not to mention the any profits. Rivian has shipped approximately 160 (true, impressive) electric pickup trucks so far, but on paper they are worth a hundred times more than Infobip.

By the way, you can calculate the valuation of the service business in a couple of excel cells where even Bakić would be relatively accurate – take a certain multiple (5x, 8x, 10x… depending on the negotiations) and multiply it with normalized annual earnings. Tajana Barančić described the methodology ).

On the other hand, estimating a platform or manufacturing business like Rivian is a more complicated job.

No one stutters while pitching anymore

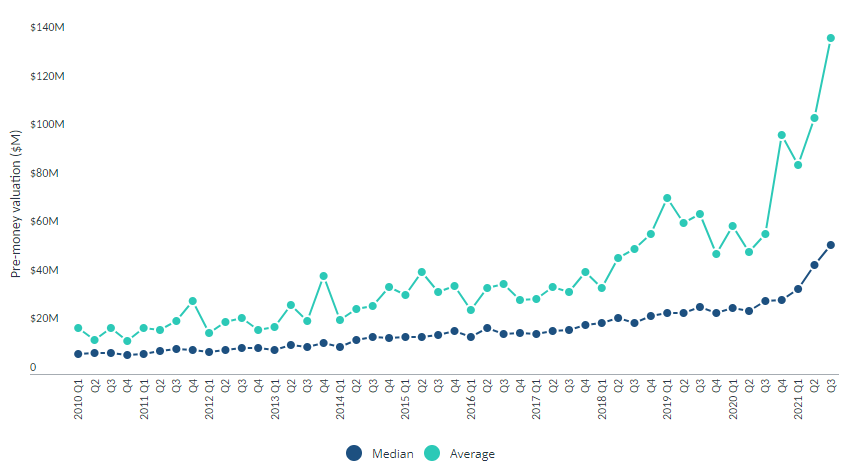

Take a look at the Pitchbook graph of pre-money valuations in the period from 2010 to 2021. The average valuations of technology firms are growing by year, and the first backdrop is that banks and funds have more and more money in their accounts.

Macroeconomists theorize that the root of such a situation is the continuous aging of the population that invests its savings in low-risk assets (apartments, bonds, classic savings…), creating huge pools of money that spill over to riskier / higher returns. Even the twelve-year-old crypto rollercoaster has been partially pushed by this surplus fund money.

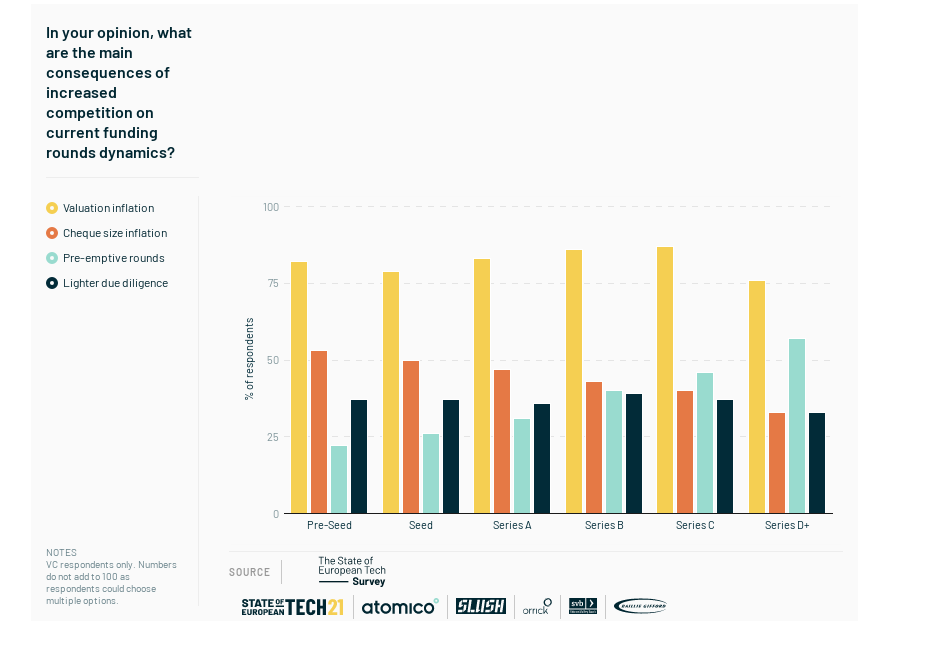

The number of investment hunters is also thickening valuations – a recent Atomic study shows that “valuation inflation” and “check size inflation” are the result of a growing number of startups…

Essentially, a company that was valued at half a billion dollars half a decade ago could achieve twice as much valuation and for similar business metrics today – and BAM! – Here’s our new unicorn.

A feedback loop filled with promises

Here we come to a bounded reality – company valuation is just the agreement of a certain group of people; based on “tramping” between investors, analysts and promising founders.

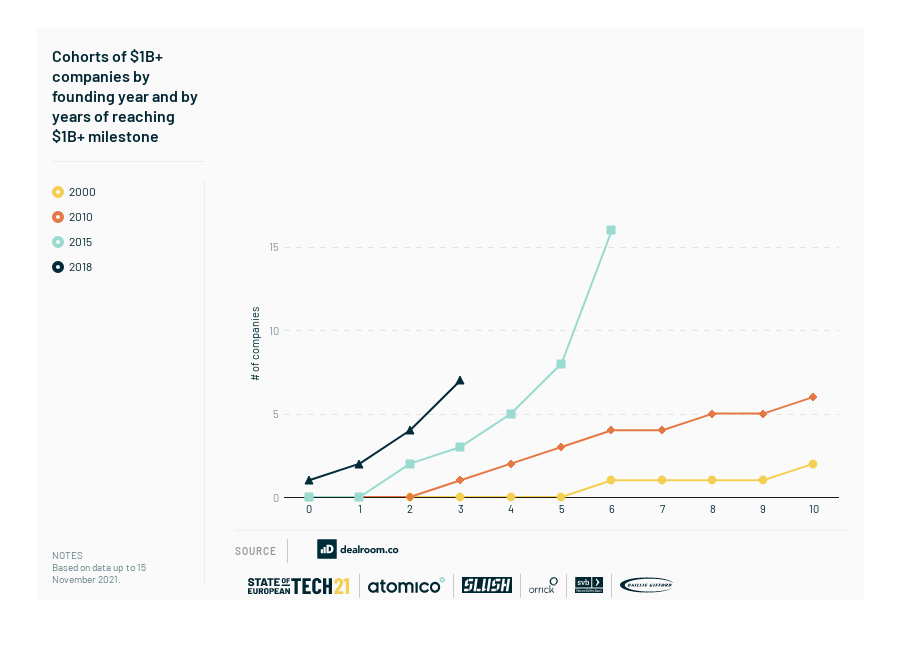

Investors are primarily thinking about a return on investment, forcing tight rounds of financing, “fail-fast” culture, and speedy company “exits”. Such a feedback loop filled with the promises of the founders created unicorns in shorter and shorter intervals, so today among Europeans there are teams that became unicorns in just one year (dark blue line)

The number of European unicorns increased by 44% last year, and such rapid growth, speedy financing, but also the lack of in-depth verification emphasize more far-reaching problems.

- Funds that could be spent on validating (less bombastic?) longer-term projects go to “shiny pitch deck” startups and Customer Acquisition cost, which in reality overflows dollars towards the GAFA front (details later).

- Insufficiently rigorous business evaluations create oversized bombs, and WeWork or the recent Theranos-style scandal can drive away investors and put a greasy stain on an objectively small scene. Pay attention to the “Lighter due diligence” item from the top bar graph that depicts relaxed investors and hints at potential explosions.

Capital markets “sell” hope, so it is logical and healthy to support brave founders and a culture of experimentation to which “fail” is not strange. But one thing is to support risky ventures that have a chance (moonshots); and it is totally different to inflate valuation and promise the market products that are not only technologically feasible but also conceptually impossible.

And we don’t have to go beyond the state-aided Sv. Nedjelja where Rimac and the rest of the Project 3 Mobility team claim that Ursula’s taxi will run without a steering wheel as early as 2024. At the same time, Chris Urmson (ex-Google / Aurora), who has been dealing with robotic vehicles for more than a decade, explains that to achieve the fifth level of autonomy, you will need at least another 30 years of development.

The problem of fully autonomous driving is essentially the problem of creating General Artificial Intelligence (AGI), and Tesla’s Full Self Driving is a typical “over-promise under-deliver” example.

That is why I have to statistically disappoint you at the end of this section – the number of unicorns simply does not correlate with the strength of the IT industry of any of the countries listed in the last column. Additional statistical confusion is created by grouping unicorns into the same basket (airtable), not taking into account how much they actually pay taxes or what their income or expenditure structure is.

The Nature of a Bootstrapped Society

The recently deceased prof. Bičanić pointed out the lack of spillover of values between unicorns and the rest of the IT scene (Maccabi effect) and said that “no one would feel the extinction of Rimac“.

Atomic’s figures show that the professor’s thesis has certain holes (e.g. talent spillover is a proven one), but now we will just step away from the topic – “the potential of the domestic IT industry” which Ivo Bičanić provocatively challenged, is a topic for future articles.

Now that it is revealed that things are never simple, I will also describe two counter-arguments that justify the rise of unicorns, funds and technology startups.

Cockroaches, but thirsty ones

The regional market is objectively underinvested – only 5% of VC funds are invested in the climate; although we make up over a quarter of the European population and create a tenth of gross domestic product.

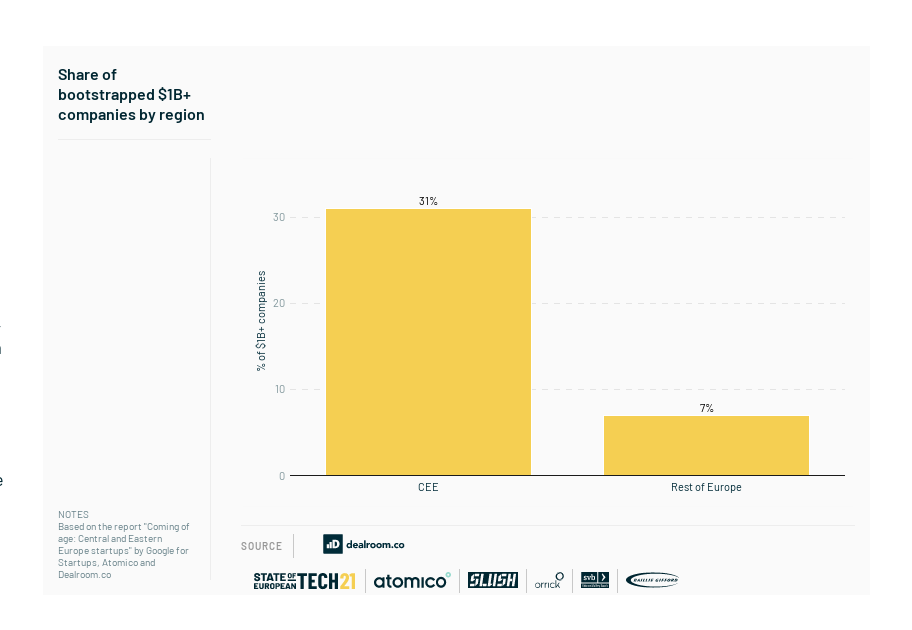

The shyness of local investors pushed regional companies into the so-called “Bootstrapping”, so this organic way of growing is 4 times more common in the region than in the whole of Europe. This tells us that domestic companies are as durable as cockroaches, but also that they are crying out for fund money of any kind.

The current startup reality is saturated and diverse; and relying on solo bootstrapping is actually risky behavior. Tamaseb’s “Super Founders” book (2021) reveals the background:

- Unicorns in most cases (70%) fight for a share of the established existing market.

- Alternatively, a situation where you open a crypto wallet to your old aunt. “Market creation” and educating new users occurs on a smaller scale (30%).

- The vast majority of unicorns operate in a market that is above average (63%) saturated with competition.

- Consequently, a large part of startup costs are not related to engineering, but to marketing (CAC) and sales activities, which can be seen in the S1 prospectuses before going public.

Ideas are cheap and market capture is expensive, so no founder can afford to generalize the ideological generalization of Jason Fried (Basecamp), who argues that startups should be bootstrapped, profitable and proud.

The exception are Web3 startups, which have proven that by issuing tokens to the community, they can simultaneously develop a minimum viable community with a minimum viable product. Web3, when you dig deeper, is actually a great example of heterogeneous funding – two prominent players, Uniswap and Axie, are cockroaches, VC-backed, and token-backed teams. Of particular interest is the growth of quadratic funding platforms such as Gitcoin, which has proven to be a valid seed round alternative for many web3 startups.

IBB in the previous article describes an important foundation of diversity of financing – “investments should be oil on fire, not a prerequisite for business”, and here we return to the earlier thesis that products should be more than a powerpoint promise.

Through the above figures, we see that the domestic scene chronically needs all kinds of financing, and most of all new fund money. But the IT industry will not live because of the funds themselves, but because of the way in which their complete resources are used, that is. smart money, network of partners, pool of knowledge and most importantly, the quality of mentors and the availability of their calendars.

Unicorns & Muggles

Another counter-argument worth mentioning is the rise of the unicorn to invoke a high-tech society – a community that lives off the sale of intellectual property and magical auto-scalable products.

There is nothing wrong with invoking “product IT”. Quite the contrary! But the problem occurs when this goes hand in hand with the declassification of “servant outsourcing”, which is an ancient domestic myth that is very easy to get into.

It is often forgotten that the service sector is a fertile incubator of production startups, but also a nursery for experienced designers or engineers; in addition to having a market role to implement digital technologies in other verticals of the economy.

I don’t want to confuse you too much, as I described in the last column with more discussion that the product VS service, like any IT polarization, is actually a fake debate. Reason being is that the same team that degrades service IT as a domestic evil, will at the same time proudly blow the horn about SPAN’s listing on the Zagreb Stock Exchange.

The biggest irony is that average unicorns are not really technologically complex companies (nor major innovation incubators):

- The vast majority of unicorns have small or medium CapEx needs. (See CAC above). Less than a third of unicorns (29%) are capital-intensive organizations.

- Approximately half of them belong to the “integrator system” level (does Infobip belong here?)

- A quarter of them can be classified under “technical” engineering (e.g. custom web application development level)

- And only 15% of unicorns have meaningful “Deep Tech” research and development (e.g. development of new computer vision)

That’s why I think FER dean Gledec would be disappointed – the unicorn’s operation consists more of scripted sales calls and brutal optimization of customer support, than of algorithmic tweaking on top of Matlab.

Diverse, sweet Europe

Young people being sagged with the burden that “they have to develop product companies” is actually reminiscent of the drama of unrealized parents forcing kids to football training, expecting them to instantly play in the Champions League.

It is unfortunate that the media amplifies this game, constantly dealing with exceptions which they then proclaim as a well-established rule. For example, the “College Dropout Founder” is one of the biggest myths of the startup world. 90% of unicorn founders actually have a university degree, and even more striking is that doctors of science outnumber founders without a degree by a large margin.

That is why it is not wise to influence young people with Americanized models that are actually inapplicable in a heterogeneous EU (did you know that Americans move 10 times more than Europeans?) In the article I argued for diversity of industry, since it allows people to discover their own path while thickening their skin.

Each industry, segment, vertical or horizontal (whichever way you want to turn it) has its own market constraints and complications so there is no single model of success. It’s absolutely okay to be a nightly PHP freelancer, as it is also totally OK to have a niche agency or run a web3 DAO. Furthermore, it is also great if you want to develop a hardware or SaaS product. All this is equally valuable in raising one’s own and general Eldorado.

And if you already decide to look for a formal investor, who is already running towards sweet Europe, do your homework with a mentor and look for fund managers that do not play financial roulette. VC funds that are more “venture” and less “capital” will support your primary need to build a meaningful product through a longer-term roadmap.

Only meaningful products and healthy sustainable teams can, with the help of academia and the State, create positive changes in the IT industry – and that is a shared medal that we can all work for.