Bitcoin – the underdog of eCommerce?

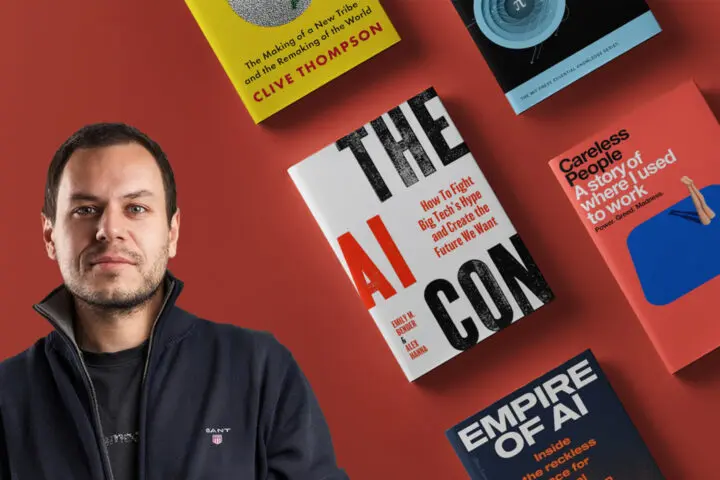

Bitcoin made a grand entrance into 2017. with market value highly over 1,000$ per BTC. Last time it’s value was so high, was late 2013.- when the People’s Bank of China approved BTC as a new way of payment. A lot has changed in 3 years. Bitcoin gained wider use on the global scene and all the major companies like Microsoft, WordPress or Steam have integrated BTC as a method of payment. Inevitably, most visible changes have occurred in the sector of e-commerce where the business owners had to adapt to the newly established trend.

The origin of the Bitcoin idea

Satoshi Nakamoto, the (alleged) founder and the inventor of Bitcoin states that Bitcoins are an electronic coin administered as a chain of digital signatures. The rumor is that Satoshi Nakamoto is actually a group of scientists and experts who have joined forces and resources to make better and more efficient ways of payment. Whatever or whoever is behind the BTC project made an alternative form of payment that is usable in the real world.

In addition to the complex math principles, special emphasis was placed on covering all monetary aspects so there would be no disadvantages/downsides in Bitcoin usage. Each owner transfers the coin to the next by digitally signing a hash (transaction number) of the previous transaction. In other words, Bitcoin protocols operate on a ‘’vicious circle’’ principle. Each transaction can be viewed separately through 2 parameters: input and output. Input references the funds from other previous transactions, while output determines the new owner of transferred Bitcoins.

Keeping and maintaining transaction records is usually the job of an accountant, bank or other financial institution. Their primary duty is to be a mediator and to take care of the documentation regarding the transactions. With the bitcoin model, this service becomes redundant because each transaction is recorded in a digital format (Ledger) and shared/distributed among users. This also means there is no fee for managing transaction documents.

Bitcoins vs. physical currencies

Bitcoin is quite different from physical currencies. The main difference from its tangible rivals is that Bitcoin is digitally created and virtually stored. Ergo, there’s no printed version of Bitcoins. If the transactions are not transmitted electronically, you can’t use Bitcoins like banknotes. But you can exchange them at any time to the currency of your choice.

Bitcoin is a decentralized cryptocurrency which basically means two things:

- It’s not controlled by institutions or governments. There is no central authority, so the BTC value depends on the principle of supply and demand

- Bitcoin depends on a complex mathematical formula written in Open Source code

Unlike other currencies, BTC is not pegged to the central bank’s rate of exchange to another country’s currency. Countries usually attach their official currency to the most stable or most used currencies on the market like the dollar or euro. This creates an anti-competitive trading environment. This principle is ok until the large imbalances occur in pegged currencies and the pegs are broken. Result- major currency fluctuations and instability.

Bitcoin’s value depends on multiple factors. Global geopolitical relations and events dictate it’s price and value to a lesser extent than common currencies. Unlike other currencies, BTC is immune to fluctuations because there is no central authority.

Recently, BTC value saw a major increase in value. Not even Brexit or US presidential elections disturbed its surge. This can be attributed to several factors:

- Separation from standard global financial flows and central authority

- Stability due to the popularity and widespread BTC usage as payment method (increased demand for BTC)

- Rapid adaptation to the e-commerce market and favorable position as an emerging trend

- Recognized status of legal tender accepted by the major players

Where is my ‘’gold pot’’ stash hidden?

But, like all other currencies, you have to store Bitcoin somewhere. Like a bank account, your socks or secret hiding place under the mattress. For Bitcoins, there’s a digital wallet where you can keep and store your precious stash.

Another option is to keep your wallet in the cloud. If that is not secure enough, there’s an option to backup your wallet in case of technical failures or human mistakes. Like the guy who accidentally tossed away 7500 BTC stored on external HDD.

The backup option allows Bitcoin owners to recover digital wallets after their smartphone or laptop got stolen. There is a catch though – your wallet must be encrypted. An ingenious thing about Bitcoin wallets is that they are completely anonymous, which means that the identity of parties involved in the transaction is safe because the only thing being used is wallet ID.

Bitcoins & IPG (Internet Payment Gateways)

Online card payments based on IPG (internet payment gateway) include the third party as a control factor between buyer and seller. This kind of control provides large financial institutions posing as trusted third parties, to process electronic payments. They serve as a factor that guarantees the stability and legality of all transferred funds and all involved parties.

They also serve as the intermediary of potential disputes which is authorized and accepted by both sides. When the transaction is executing, a transaction fee is charged for mediation and extra services. The obvious downside – fees are charged on the percentage of transactions.

Logically two things can happen:

- Smaller transactions are initially more expensive due to additional charges

- Bigger transactions are sometimes unprofitable because levies significantly raise the cost of the transaction

Bitcoin solution is an electronic payment system based on cryptographic proof instead of trust and the payment of additional levies. This allows any two willing parties to transact directly with each other without the need for a trusted third party. There is a public ledger with records of transfer information (wallet IDs and timestamps) so they can’t be re-spent. For this reason, all the transaction information are simultaneously updated and shared in the public ledger (blockchain).

There is no place for the subsequent change of entered data because once the data is entered in the block, previous transactions are taken into account. When there’s an attempt of counterfeiting information and reusing already spent Bitcoins, all users that have ledger access and see changes introduced subsequently. Among other things, there are visible changes and discrepancies in the total Bitcoin amount and blockchain.

If you’re worried about security – don’t be! The Bitcoin network is secured by the ‘’miners’’. Their job is to verify every new transaction and keep the ledger updated. For the work they do, miners receive compensation of 25 BTC, which makes them ideal guardians of that information. It’s in their own interest, as much as yours, that the ledger is filled and updated with accurate transaction information.

Credit/debit cards vs. Bitcoins

There are a few more things that make a big difference between credit card payments and Bitcoin transactions. The most obvious one is the simplicity of making transactions with Bitcoins compared with conventional methods. Authorization of credit card transactions needs to go through third-party authorization such as a bank or other credit card issuers.

The time factor – as all credit card payment transactions must go through the approval of the third party, there’s a time delay for payment verification and transferring funds from the buyer to the seller. With Bitcoins, that process is super fast and transparent to both sides. There are no CVV numbers, declined cards or transactions because your name was wrongly spelled. Basically, a Bitcoin transaction is simple as sending an e-mail.

In standard IPG payment methods, sellers must often wait long periods of time for payment to clear so they can ship out their products. In some cases, it may take up to several weeks for the real money to land in your bank account. For example, when it comes to paying with cards and credit cards, Paypal keeps the transferred funds for a month and Stripe has 7 days term for keeping funds. With Bitcoins, you can be up and running in a matter of minutes.

E-Commerce & Bitcoins

One of the simplest and easiest ways to integrate Bitcoins into your own WooCommerce or eCommerce application is through existing IPG such as Stripe. With Stripe, all payment options and currencies are integrated to achieve a much simpler and faster way of transactions. It allows users to accept payments and make transactions all over the world.

Once the customer has the option to click on the BTC preference he can finish the transaction by scanning the QR code or with Wallet ID. Prices are automatically converted according to the exchange currency. After that, the transaction needs to be verified and completed. Funds are automatically transferred (without time delay) from the account of the buyer to the seller balance.

What does this mean for business owners? With BTC they can ship out products instantly and rely on transaction resources. In addition, they can advance and improve the speed of distribution and business liquidity, reduce paperwork and get rid of unnecessary procedures.