Crypto is not a playground anymore (Ukraine & Terra Luna know why)

Now a cult classic, Zelensky’s speech declaring he needs “ammunition, not a ticket out of Kyiv” painted a vivid picture of how Ukrainians will stand up to the Russians. Support from the West and sanctions soon followed, but a faction of the crypto community, hiding behind a facade of neutrality, hasn’t quite “bitten the bullet” yet.

The hypersonic Iskanders that struck Kyiv at 5 am heralded a brutal Russian aggression; but they also signaled the swiftness of Ukrainians in mounting resistance on all fronts – including the digital one. At that time, Valeriya Ionan, like a multitasking COVID-era parent, was calming her son Mars while preparing for a war-time Zoom call with her boss – Mykhailo Fedorov, the Minister of Ukraine’s Digital Transformation.

That crack-of-dawn meeting would go down in history as the beginning of the grand “smartphone war”, a plot twist that would send shivers down even Jason Bourne’s spine – the constellation of Starlink satellites aids drones in targeting Russian objectives, TikTok bots compile military open-source reports, and web3 protocols and crypto donations have become a crucial part of the Ukrainian defense doctrine.

Although the world largely agreed on condemning the invasion (more so) and imposing sanctions (to a lesser extent), a segment of the crypto community tangled itself in a knot of self-gratifying technological neutrality, avoiding the implementation of an embargo against Russia.

The dilemma of “what crypto should be” has been around for years – transparency and security on one hand; privacy and financial freedom on the other. The problem is that debates and divisions on other issues tastelessly prolong the war and, in the case of cryptocurrencies, bury web3 even deeper in its own challenges.

In this article, I will analyze those challenges (and whether they’ve helped the crypto community mature) by first examining Ukraine’s use of cryptocurrencies, and then delving into Russia’s illicit crypto activities, which are turning out to be an objective reason for imposing an embargo. In the second part, we will return to the foundations of the web3 community’s divisions, such as toxic positivity and the intoxicated need to view every human activity through tokens or yields.

I will also touch on the current Terra Luna situation, which unfortunately has ties to Ukraine, but let’s start with the positive side of the coin…

Ukraine’s web3 triangle

You don’t have to be a PR expert to see how Valeriya and Mykhailo are giving the Russians a run for their money in the virtual aspect of the conflict. The tech industry’s support for Ukraine is objectively unwavering, even when considering the Western media bubble we live in.

Wholehearted support also came from the founders of major blockchain systems – Gavin Wood (founder of Polkadot), Anatoly Yakovenko (co-founder of Solana), as well as Sam Bankman-Fried (CEO of FTX exchange) and Vitalik Buterin (creator of Ethereum), who actively participated in establishing the Ukrainian crypto fund (Ukraine Emergency Relief Fund).

Within just two days of the aggression’s onset, Ukrainians established a financial triangle between the central bank, FTX exchange, and the ministry, essentially creating a massive virtual vault accessible (for contributions) to everyone around the world. Alex Bornyakov, Valeriya’s Zoom colleague, shares more details about this unprecedented move…

The launch of the fund has reinforced the narrative of cryptocurrencies as the primary method for future public war donations:

- As of writing this article, the fund has collected over $60 million (Dune dashboard).

- According to Alex, crypto played a significant role in the urgent procurement of military equipment, as SWIFT transactions were hampered due to the disrupted operations of domestic banks (18:45).

- Many Western suppliers opened Coinbase accounts solely to expedite the processing of equipment purchases for Ukraine (26:05).

- Alex points out that cryptocurrencies were extensively used in preserving refugee funds. The volume amounts to hundreds of millions of dollars, with some of these funds being deposited into the Terra Luna network, which I’ll describe in the final section of the article.

- The open faucet of donations accelerated the approval of a favorable Ukrainian law on the web3 industry, which recently received Zelensky’s seal of approval.

To further “spice things up,” Valeriya’s team announced a token airdrop on March 2nd, thereby creating the world’s first crypto war bond, which offers donors a potential return or reward for their donations.

Such swift and meaningful reactions didn’t occur haphazardly – Ukraine has a dedicated “IT” ministry, the percentage of people working in the digital sector is three times higher than in Croatia, and the same team has substantial experience in crypto operations. Little is known about their 2018 trial of a central digital currency (CBDC), during which they circulated around 5,500 test e-hryvnia tokens.

But if you think Ukrainians wear the crypto crown, wait until I tell the story of the thrifty Russians and one mysterious black skyscraper.

Saving the Ruble in a Cozy Crypto Sock

Macroeconomists argued during the invasion that crypto markets lacked sufficient liquidity for Russia to evade sanctions – for example, a Moscow-based company clandestinely importing truckloads of chips and paying for them in some token; or a panicked oligarch concealing billions of dollars. In principle, this is true – the entire ecosystem of mixers (applications used to “launder” crypto, e.g., Tornado Cash) has a daily liquidity of about $30 million, which is insufficient for continuous games of hide-and-seek.

However, the tech community knows well that transactional evasion of sanctions is just a minor part of creative crypto options.

For instance, Putin began to support bitcoin mining, relying on the “Tehran Model” of easing sanctions – Iran has been among the top 7 countries in active bitcoin mining for years and had to introduce a mining “trade permit” to systematically plan the load on the power grid.

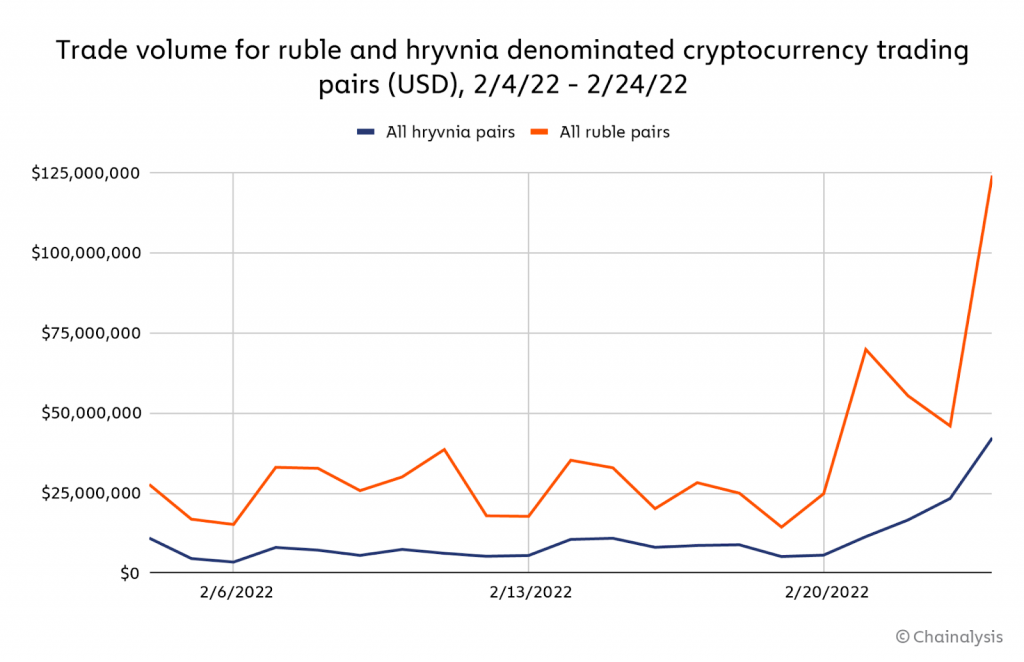

More importantly, crypto has been used in Russian households and legitimate businesses as a hedge against the loss of ruble value…

In just a few days after the invasion began, the volume of conversions to cryptocurrencies jumped fivefold, and one Moscow observation point played a crucial role in these shenanigans…

Vostok: The Legend of the Dark Tower

Moscow’s Federation Tower East (Vostok) would be a typical office skyscraper if it weren’t for certain details – over fifty crypto companies, over-the-counter (OTC) exchanges, “security IT firms,” and a couple of flashy Lamborghinis are registered at the address, suggesting that it’s actually a front and the world’s largest hub for militarized crypto operations.

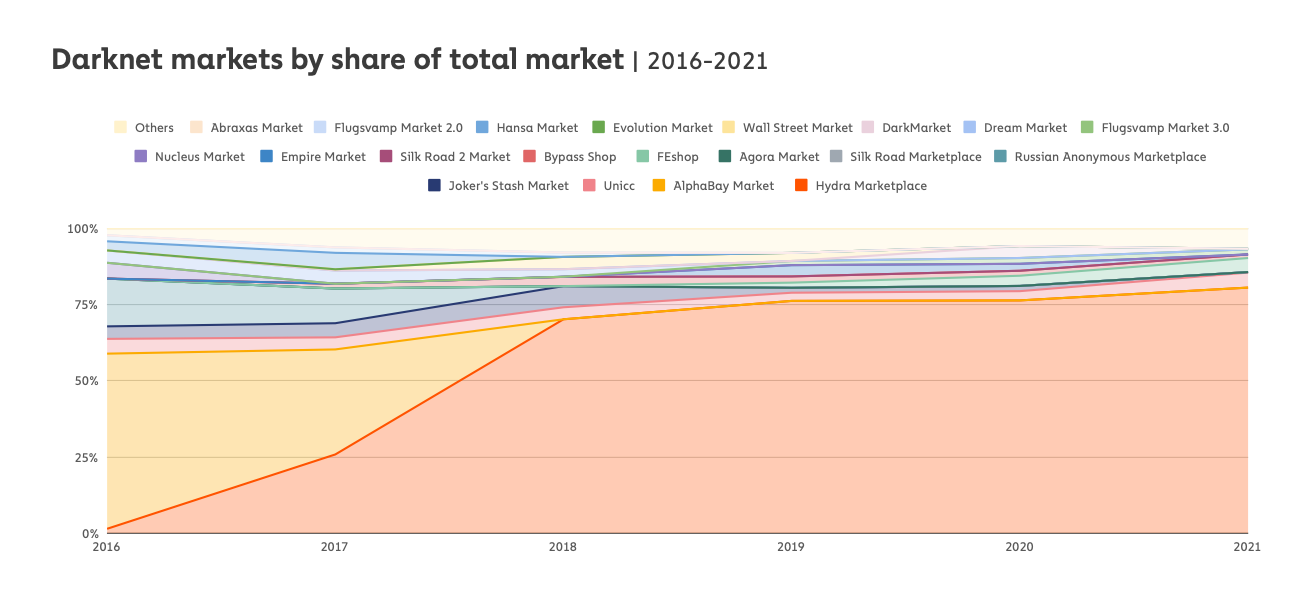

For starters, Russia controls over 80% of the entire Darknet – an unindexed part of the internet accessed through the TOR browser, where you can buy revolvers, weekend entertainment, and even a kidney.

The Darknet has a direct connection to armed conflicts, as it is instrumental in the distribution and operation of many malware, ransomware, and cyber warfare operations. You won’t hear much about such actions in the media because organizations affected by ransomware attacks silently agree to the hackers’ terms, calculating that crisis communication is a bigger headache than paying the ransom.

The use of cryptocurrencies and the darknet, as well as ransomware tools, has proven to be an integral part of Russian aggression. For instance, Valeria’s offices had been under active attack since January, and even President Biden had earlier felt the headache caused by a cyberattack on American oil pipelines.

However, the Russian hacker network does not only target Ukraine and the US – approximately three-quarters of all global ransomware actions can be directly linked to Russia. The largest so-called Ransomware-As-A-Service players like Conti, Darkside, Phoenix… they all have connections to Vostok. The same goes for the army of fake users and trolls spreading Russian crypto-driven propaganda.

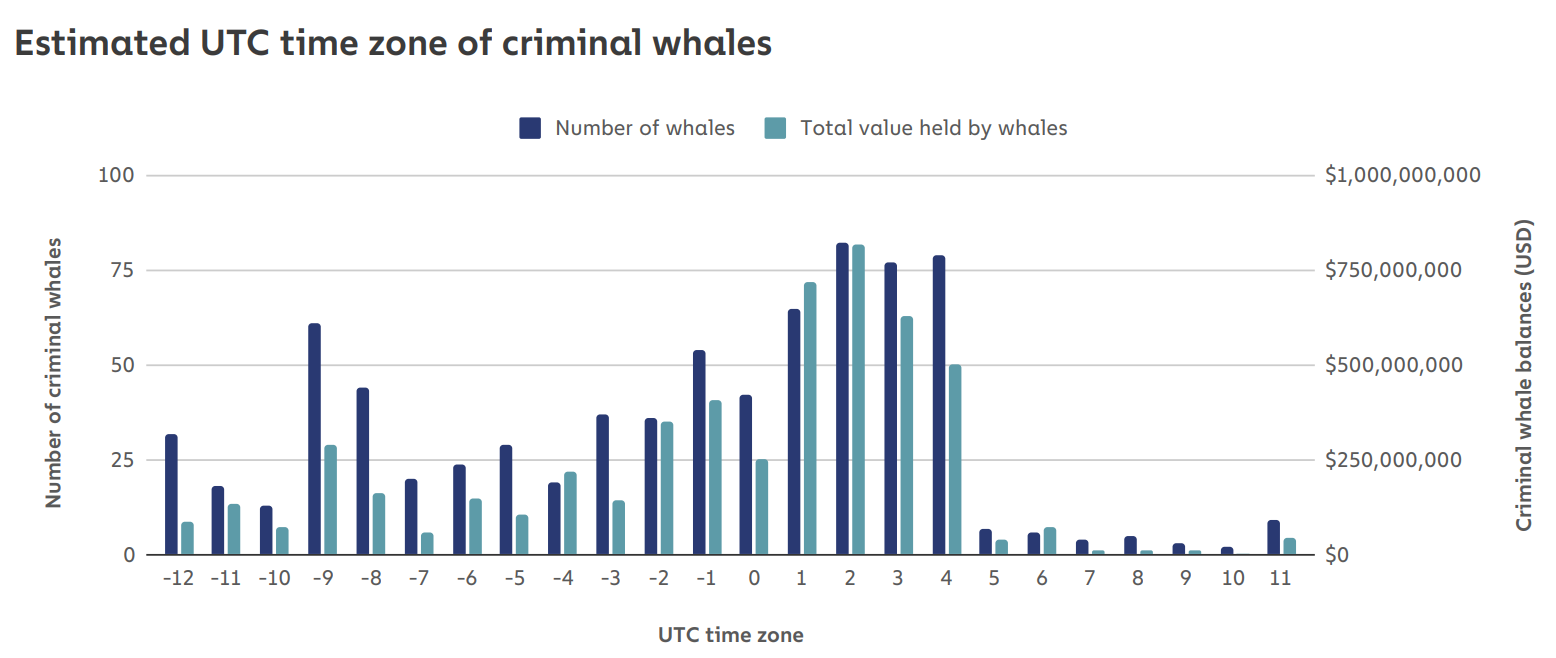

Even when analyzing all global illegal crypto operations, meaning not just cyber warfare, we arrive at the point that the majority of criminal crypto players are located in the longitudinal area of Vostok…

In the above graphs and data, it’s clear that the myth of Moscow’s cyber-warriors (unlike the bumbling conventional army) has a real basis, which raises the logical question of why the crypto industry hasn’t more forcefully “stepped on” Russia, and specifically the team from Vostok.

To find the answer, we must move away from the dark tower and look towards the characters with rose-colored glasses, because as it usually goes, the web3 community has long been ignoring the digital Russian threat.

Intoxicated crypto bros pose a significant threat to the web.

The militarized use of cryptocurrencies began to be discussed around the time of the introduction of the SWIFT ban (second round of sanctions?) – Western regulators were itching due to the described “ammunition” potential of cryptocurrencies and started suggesting that the web3 community implement the maximum possible ban on business with Russia.

The proposal for a crypto embargo wasn’t particularly strange since traditional tech companies had already implemented maximum sanctions; we’re talking about the FAANMG “web2” group worth approximately $10 trillion (I would write “six times more than Russia’s GDP”, but stock & flow shouldn’t be compared).

Part of the crypto community rejected the regulators’ proposals and continued doing business with Russia – essentially enabling the smooth operation of the Russian cyber warfare machine. Not only that, web3 guys (Binance, Coinbase, Kraken…) decided to lecture the public on how crypto should remain technologically and business-neutral, i.e., maximally decentralized.

This lazy argument has already become a tiresome “go-to” rhetoric when trying to avoid discussions on difficult topics. And there’s no shortage of difficult issues alongside the demonstrated cyberwarfare – poor user experiences, lack of inclusion (the share of women in crypto is three times lower than in the rest of IT), pollution of the planet, and financial scams are just a reflection of the state of mind of some tech-bros who, amid an abundance of free VC money, talk about technological determinism that preaches that algorithms alone will solve the world’s problems…

- First, such reasoning is conquering the wrong hill – decentralized technology cannot create a fair decentralized market on its own because online society is not troubled by technological problems, but by “human” issues of coordination/communication.

- Second, the holy grail of decentralization is actually a false developers’ grail because technology, algorithms, and automation crave consolidation, not the opposite – a quarter of the entire Ethereum operation is already held by Jeff Bezos (AWS), and a clique of just three companies (Foundry, Poolin, F2) mines half of the Bitcoin network.

Imagine, for example, that Google decides to buy ConsenSys to integrate MetaMask into its refreshed digital wallet… Does this move raise engineering issues or rather questions of privacy, censorship, and locking users into an ecosystem?

Tim O’Reilly and Moxie Marlinspike have previously described the problem of the “promised web3 land” – the conclusion is that consolidation and centralization are continuous economic dance-floors, which are broken up as needed by meaningful regulation and a dynamic market, not just by technological intervention. After all, “tech” can’t even recognize a chimpanzee, let alone bots or hate speech.

The greatest irony is that the same crypto brothers who advocate decentralization and “financial freedom” for small Russian users are precisely the people who will throw those same users under the bus. During the war, Reuters discovered that the Binance team had close ties with the Russian government and continuously (!) provided the FSB with information on all transactions and manipulations.

This doesn’t mean that we should give up on “decentralization”; on the contrary, sensible decentralization strengthens parts of the web3 building blocks (look at the new OpenSea NFT Seaport), but it’s not the only cog in society, nor a good “catch-all” answer for avoiding difficult topics.

Balkanization, as the mother of all problems

In fact, the crash of the Terra / Luna / UST system more accurately reflects the avoidance of important issues and throwing users under the bus.

In the largest historical crypto debacle, $60 billion was wiped off the face of the earth, and it is less known that among the savers were a significant number of Ukrainians for whom UST was a refuge from the devaluation of the hryvnia (recall the earlier graph and the warm savings sock).

Over a quarter of affected users took out loans to invest in Luna / UST, the average value of savings was at the level of five years’ income, and 40% of investors affected by the collapse considered or committed some form of self-harm.

Here we come to a deeper reality – web3 is a brave new industry with a wealth of potential and innovation, but it currently suffers from metastasized toxic positivity in which the excessive monetization of “everything living and non-living” balkanizes the entire industry. For example, Vitalik Buterin and many other members of the crypto community have long warned about the death spiral problem with the Terra system, but their sirens were met with ridicule and dismissal. Unfortunately, the disunity regarding the insurance of the Terra Luna system was actually expected, and the same goes for the topic of crypto sanctions against illegal Moscow players.

Crypto is no longer just a playground for the chosen few

Indeed, extraordinary circumstances like the Russian aggression or the massive “stablecoin” collapse are ungrateful and chaotic situations for questioning the industry; however, such moments shed light on the real state of the sector and, therefore, are good catalysts for long-term development.

The fact is that crypto is no longer a playground where people “go to be free” – crypto has become a marketplace accessible to the entire world, a place where all shades of protected and less protected users can be found.

Inclusion, accessibility (A11Y), end-user focus, fostering self-criticism, a well-aligned partnership with regulators, and yes, applying surgical sanctions when needed; should be constant goals not only for the crypto community, but also for the tech industry in general.

Because, if we just blindly build without fixing both existing and new web infrastructure, we will continue to accumulate user experience issues and invite hasty regulation that no one needs. In this way, web3 technology can evolve, but will lose all those users it had eagerly wanted to save.