WSPay WooCommerce payment gateway plugin by Neuralab

“Show me the money!” is a fairly good movie quote, summarizing thoughts for every business owner. It’s even more powerful in the eCommerce world where store owners need to tackle various foggy and uncertain concepts like User eXperience, sales funnels, big data analytics, A/B testing and even “what the hell is CMS”.

Payment gateways are among these foggy digital concepts. Everybody “knows” that they are needed, brands like PayPal are publicly known, but nobody understands what they actually do. Let’s clear that right off the table…

internet payment gateways are a mandatory part of every web store, in charge of processing credit cards so that the customer order is fully paid.

Their full scope lies in managing the complete online payment process – taking credit card info on the checkout page > processing credit card and removing funds to cover the customer order > taking funds and placing it in the store owner merchant account > transferring funds from merchant account to store owner’s bank account. In this last step they really “show you the money” 🙂

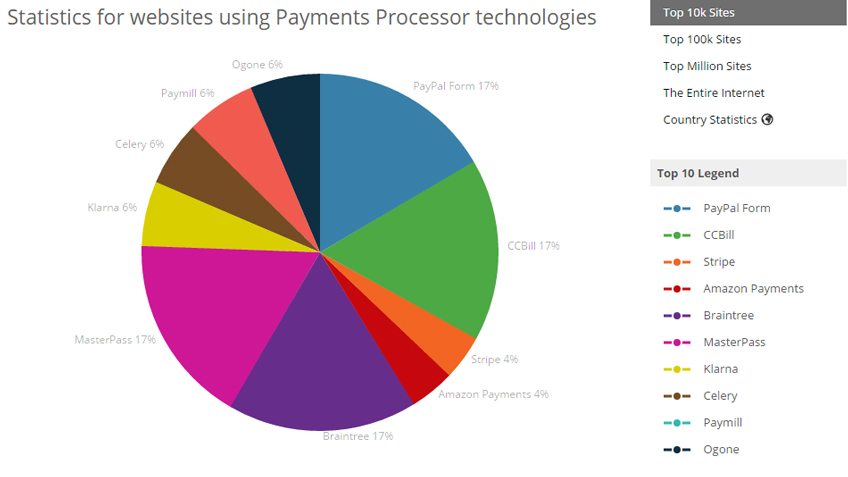

Payment gateways have a lot of options – they can process various forms of payments like Bitcoins, debit cards, bank accounts and of course, credit cards. They can also process payments in rates, phases, or even with a postponement. As the market for various technologies grew, so was the field of Internet Payment Gateways (IPG). Their business model is simple – they will take a small percentage from every transaction that you as a store owner process. In that way, their service to you as a store owner is pretty straightforward – if you don’t make money and transactions on your web shop, the gateway will not take any money from you, but if you have a lot of transactions, the gateway will take a percentage from every transaction and earn revenue for its own operations. Gateway percentages are usually around 1 to 3 %, but they vary in scope and type of percent, fixed or variable fee.

One of the important questions for every IPG is the ability to send collected funds to the store owner’s bank account. It’s reasonable to think of this process as the most important part of the whole eCommerce process. This is the phase where the owner has made the sale, charged the customer’s credit card, and shipped the product, but it’s still waiting for the money! It’s reasonable for every store owner to be on pins & needles and get the real money. That’s where the local internet payment gateways have their advantage – they can easily (fast!) transfer funds from their account to a local bank account.

One of the good Internet payment gateways in Croatia is WS Pay, an IPG with a fair amount of experience in the eCommerce payments field. Their platform can process credit cards, and debit cards, take rates and payments in phases and is specifically geared towards the Croatian eCommerce market as they can easily push funds to the Croatian store owner’s bank account. Also, local support via email, ticketing system or phone is always a good thing when dealing with real money.

Having built over a dozen large eCommerce systems in Croatia, we generally always recommend WSPay when implementing Internet Payment Gateways. This is the reason why we decided to develop and freely OpenSource our own custom plugin that integrates WooCommerce with the WSPay system. Note that you will need at least a demo WSPay account to make this work.

This WordPress / WooCommerce plugin is developed having our “Clean & Simple” plugin philosophy in mind – only rudimentary lines of code are included with zero tolerance for bloat or unnecessary function. Currently, the plugin works on the redirect principle, but we are working on publishing version 2.0 which will include an inline form for credit card processing. On a side note, this plugin is provided “as-is” and we don’t currently provide support around installing and optimizing it for your needs. Look at it as a starting ground for WSPay processing.

Hop into Github, download the plugin and tell us what you think!