The day Bitcoin stepped aside for Ethereum: What can we learn from one of the greatest software endeavors?

Today marks the historic transition of Ethereum to a greener mode of operation, which, besides energy savings, brings crucial lessons for the tech industry on developer misconceptions and complexities, as well as enthusiasm, community, and embracing risk.

“Bundle up, avoid drafts, grease your bike”… I don’t know about you, but media advice surrounding the energy crisis sounds like a well-meaning granny.

Without delving into conspiracy theories about the “elite” wanting to shift responsibility for climate change and savings onto the exhausted populace, it’s clear that it’s more editorially appealing to let Milanović ramble on about air conditioners than explain deceptive industrial offset programs – or crypto mining that “devours” electricity like our entire region.

I’m not saying Granny’s advice is irrelevant; quite the contrary, but our industry faces far greater problems than sorting after-party craft bottles.

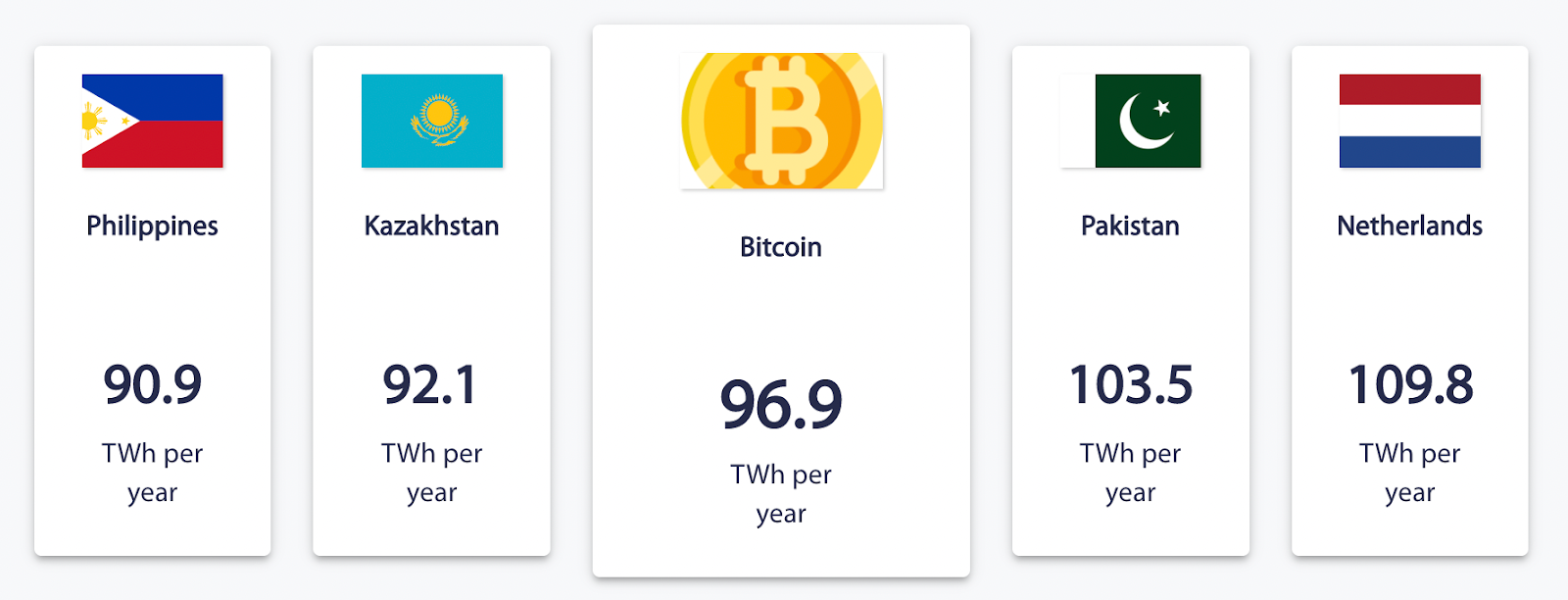

Globally, IT is consuming an ever-growing slice of the energy pie – by 2030, data centers, crypto miners, servers, and devices will use up to a fifth of Earth’s electrical power.

Armchair generals will be right when they squawk “but IT and crypto systems create immense value.” However, that’s not the point. Throughout this article, I’ll describe how cryptocurrencies don’t have to pollute the planet, regardless of the value they create.

And a quick disclaimer – when it’s said that cryptocurrencies pollute the planet, it primarily refers to mining or securing the networks of the two largest systems, Bitcoin and Ethereum, which make up roughly 60% of the market. The good news is that other blockchain networks (Near, Polkadot, Cardano, Solana, etc.) already use greener methods, so they won’t be the focus of this article.

Even better news is that the Ethereum community has just parted ways with dirty mining, becoming a green and publicly acceptable asset. What this exactly means for the crypto future and the entire IT will be described in the second part of the article.

However, the bad news is that the Bitcoin crowd consistently outclasses Ethereum’s efforts and sticks to their polluting ways – once again proving that the intoxicated crypto bros are a significant threat to the entire digital landscape and the global energy picture.

The battle between these camps and the intoxication with technology was spurred on by one developer’s mistake, which leads us to the first lesson of the article that…

Developers are not gods

You know that old LinkedIn viral about the dimensions of the American space shuttle being dictated by the width of a horse’s backside? It’s somewhat similar with cryptocurrencies, where older algorithms and ways of thinking determine how we operate with blockchain systems today.

Namely, Bitcoin mining was developed based on the HashCash algorithm, which was initially intended to prevent spam. The cypherpunk community at the time, led by Adam Back, created a system where you would consume some computing power for each email sent, effectively “signing” the message. The idea was that spammers, who send millions of messages per month, wouldn’t find it worthwhile to mess with that much computing power – and thus, the experimental “proof of work” algorithm was born in 1997.

Satoshi took Back’s algorithm and repurposed it to secure the Bitcoin system. The crypto community at the time imagined that every user would lend their processor and graphics card to the Bitcoin network, allowing the world to finally have a parallel, decentralized, and independent financial system. At that moment, Satoshi made a classic developer mistake – the assumption that the algorithm would successfully transfer from one environment to another.

Unlike the email signing process, the Bitcoin network requires your computer 24/7 and offers you a certain income (mining fee) in return. Consequently, securing Bitcoin has become a ruthless business where the mining process has become completely industrialized, specialized (ASIC), and ultimately relocated to data centers that consume enormous amounts of electricity…

As it usually goes in the tech sector, profit encourages consolidation, which is the second unintended consequence where only three mining cliques control over half of the Bitcoin network. In other words, Satoshi’s well-intentioned vision of end users securing the Bitcoin network with the same fervor as their personal email has, unfortunately, fallen by the wayside.

To stray even further from Satoshi’s vision, Bitcoin maximalists have built a cult around their algorithm, refusing to change their mode of operation, and even proclaiming that Bitcoin mining actually utilizes “untapped portions of electricity.” 🙄

Just so we’re on the same frequency:

- Kazakhstan, Georgia, Kentucky, and Texas are the most common mining locations, where coal, gas, and oil are predominantly burned.

- Even if you buy into the pseudo-argument that Bitcoin uses electricity exclusively from wind, water, or solar sources… it just means that the same energy is being denied to another consumer.

- There are no “untapped” portions of electrical energy that one consumer can selectively use. Excess generated electricity is sold (redistributed), and deficits are purchased in a continuous process that is not visible to end consumers.

Also, consider that mining, as well as renewable energy sources, generate large amounts of electronic waste. Related problems include inflated component prices, leading to imbalances in the computer equipment market and aversion towards the crypto industry. It is well known that certain video game manufacturers have turned against NFTs, DAOs, and similar Web3 concepts since gamers, through no fault of their own, had to pay multiple premiums for graphics cards

Generally, the negative consequences of IT systems can be somewhat anticipated and reduced if you foster a diverse team of designers, analysts, engineers of all kinds, as well as sensible regulations. Something that the tech, and especially the crypto community, largely lacks.

The point is that programmers are not gods. They are usually experts only in their narrow niche, using shortcuts and existing short-term solutions (like everyone else) whose long-term repercussions on the market or users are unpredictable. Least of all by themselves. That’s why in my previous article, I emphasized that crypto is no longer a playground – New York has practically banned mining, and the central EU bank announced a ban on the entire mining algorithm by 2025. Such regulatory pressure will only increase as energy prices rise, and even the White House has raised eyebrows.

However, such announcements don’t rattle the Ethereum community’s shorts, as its members have known from the start that they would eventually switch to a greener mode of operation. More precisely, Ethereum, when launched in 2015, used a modified Bitcoin algorithm only as a temporary solution; experienced folks here will immediately recall the second lesson that…

Nothing is more permanent than temporary solutions

October 2021, a conference room in Athens gathered a select group of engineers – in a drama that could easily rival SpaceX’s landing in reverse, as well as a level of enthusiasm that the web industry hasn’t seen in a long time. The Ethereum team, after years and years of programming, was finally testing the green version of the system, where even the slightest hint of a mistake would mean additional late-night programming, repeated missed deadlines, and disappointment from the community.

The shaky knees at that demonstration were merely a reflection of the importance of the network that had established itself as the de facto web3 protocol in 7 years:

- Ethereum processes $30 billion in contracts and transactions daily, i.e., 3x more than the Bitcoin network;

- Over 4,000 developers work on the Ethereum ecosystem;

- Ethereum’s “operating system” (Ethereum Virtual Machine – EVM) is currently used for almost all modern blockchains (Near, Avalanche, Tron, Phantom, Polygon, Binance, etc. Even Cardano and Polkadot have developed compatible adapters);

- The Ethereum network and related ecosystems currently process 20x more fees than the Bitcoin system.

An interesting catch-22 is the fundamental innovation of cryptocurrencies that, for the first time, technology has a native asset class, enabling direct public investment but also direct pressure from funds, banks, and “the people” on the crypto community. This is something that the innovators of the light bulb, television, or traditional web applications have never experienced. Many, therefore, compared the transition to an eco-friendly mode to changing the engine on a flying airplane – so it’s not surprising that the Ethereum team sang the mantra of the only dev god John Carmack with “It’ll be done, when it’s done.”

And the chanting takes us back to the Greek room – after seeing the test transactions running smoothly, Ethereum developers could give themselves a round of applause and temporarily breathe a sigh of relief – the green mode was proven to work, and the migration (which you can follow live) was finally set for mid-September 2022.

Tech digression ahead: New tested system also depends, among other things, on miners (in this case called validators) – all you need is a decent computer with 32 ETH staked. That staked Ether is actually a guarantee that you will be an honest validator, and the network will provide you with a yield of 3% to 5% annually for that effort. That’s why the entire algorithm is called “Proof Of Stake.”

Ethereum’s migration to PoS will not reduce transaction costs; transactions will speed up somewhat (about 10%), issuance of new Ether will be reduced by 90%, but the biggest benefit is that energy consumption will be reduced by 99.95%. PMs in the corner of the room are shouting, “OK, but what’s the trade-off?” i.e. why didn’t the Ethereum community switch to a green mode earlier?

Technologically speaking, the PoS algorithm is a far more advanced (read: complex) token economy with multiple types of participants on the network, so there was a real danger that Ethereum would never take off due to excessive and premature complexity.

The same issue probably plagued the Bitcoin community, but there are also deeper socio-economic problems of delay that continuously plague all open-source communities.

Beaches, Roads, and Open Source Projects

“Fuck it. I’m not doing this shit for free anymore, especially not for Fortune 500 companies,” proclaimed the cryptic Marak Squires on his GitHub profile, where sustainability of open source projects was being discussed. A little later, in January 2022, everyone could see the repercussions of these announcements – Marak had sabotaged his popular open source modules and automatically declassified about 23 million related web applications.

In the background, Marak’s subversion repeatedly reopened the question of leading and financing open source projects that, let’s face it, are crucial pipelines of the internet:

- Linux currently holds over 96% of web servers.

- Android holds 85% of mobile operating systems.

- WordPress holds 65% of content management systems (CMS).

- WooCommerce holds a third of all eCommerce applications.

The common thread among all of these open source projects (including Bitcoin & Ethereum) is not only their enormous market power and role as crucial infrastructure, but also their vibrant community of engineers, testers, and designers who invest their free time to make the average programmer’s job more comfortable in finishing the next client project or product feature.

The fourth common thing is that open source projects need more than just that to have smooth timelines, uninterrupted collaboration, and all the possible “perks” that programmers are otherwise pampered with. In other words, open source projects are actually public goods of great importance that mostly depend on the enthusiasm of a group like the one you could see in the Greek Ethereum room.

The problem with “enthusiasm” is that it’s not the only resource needed for long-term building of web infrastructure – we can no longer expect cobbled-together solutions to handle billions of dollars worth of web, eCommerce, or web3 transactions. The delay in the green Ethereum is thus a reflection of the state of complex open source projects.

Potential solutions are already known to everyone – governments, for-profit and nonprofit organizations will have to find a mechanism to better support and finance open source projects – especially if they expect reliability and a meaningful development plan from them.

Matt Mullenweg has already talked about the, admittedly debatable, “Five for the Future” philosophy, and the Ethereum team has not been idle – quadratic funding is a technology that should further level donations to OS projects.

It is also known that central figures in the community (Linus Torvalds, Matt Mullenweg, Vitalik Buterin…) are positive figures in open source projects, but not as centralized dictators, but as a unifying factor that helps the community maintain focus and attitude. For example, the developer outflow in Ethereum is lower than in other crypto systems. The same team has proven that it can maintain cohesion through four bear markets and deliver one of the biggest software undertakings of the millennium.

That brings us back to the title, but also to the end of the article

The Bitcoin community has even withstood a respectable eight bear markets, but with one note: Bitcoin projects – unlike others (Ethereum, WordPress, Android, or Linux) – seem to ignore society/market and blindly maintain the immutability of that “digital gold.” Aside from the described problem of environmental pollution, the Bitcoin community is also troubled by the basics of economics (in the form of reduced mining profits), so it will be interesting to see further resistance to the system change.

All developers on any project should avoid such calcification, as the market continuously proves that there is no place for maximalism in software development.

And it probably doesn’t matter when or how Ethereum will surpass Bitcoin in market capitalization, considering that we are heading towards a heterogeneous crypto coexistence anyway. But if developers don’t understand that “only change is constant,” they will not only have to give up their first place to their competitor, but they will also develop their projects only for dusty internet archives.

In any case, the Bitcoin community will now have harder days justifying their positions. It remains to be seen whether the “bear markets” were an easier bite than the politicians and grandmothers who, in light of upcoming gas bills, will no longer be as benevolent.