The bull run yell, is boring as hell

The crypto bear market reigned supreme for two long years, so the current rallying for a bullish return is a predictable human endeavor. However, reducing technology to a mere price roller-coaster fuels superficial narratives that persistently distort the web3 industry – a trend that’s been ongoing for 15 years.

You’ve probably come across Nassim Taleb through his ‘Black Swan’ book, but he caught my eye when he tweeted out Bakić, calling him an idiot. The two had a bit of a pandemic spat, and Nassim’s hopping from one domain to another quite impressed me. Silly me.

Taleb, aside from taking down armchair epidemiologists, consistently needles the web3 community. He does this in the manner of a weekend economist (‘it’s all a Ponzi scheme’), a dusty developer (‘why do we need blockchain when we have SQL?’), or that annoying FinTech omnipresence (‘Visa processes 56 thousand transactions per second, crypto bros are so far behind’).

I hope the Web3 community has grown immune to these worn-out quasi-arguments (Visa actually processes 1700 transactions per second); but my heart skipped a beat when Taleb pulled an old-school statistical trick more befitting the Trotter family than an emeritus.

The professor took a chart of the then-poor state of the crypto market and cunningly declared that Bitcoin’s declining trading volume from 2021 onwards signifies the implosion of cryptocurrencies! He (of course) neglected to show the growth from 2009 to 2021; not to mention the fact that we are currently emerging from the ninth crypto winter – which wasn’t so chilling since in 2011, 2013, and 2018, we’ve seen market values slashed by up to 93%. 🥶

But I write all this not because of Taleb and his ‘technical analysis’ of bears, but due to the fact that the media, social scientists, and a significant portion of the tech community use cryptocurrency prices as narrative kerosene for shallow stories. In their view, Web3 is a vast field of scams, quick riches, and technological meandering – which insidiously undermines most of the quiet efforts to create a more open internet that puts the user first.

The crux of the problem is that we – the web3 community – are the main cause of this state.

Inspecting the obvious

Bitcoin, Ethereum, and other Web3 technologies have been declared dead over 474 times, but the fundamental reason for the ease with which Taleb and various media toss around such predictions consistently flies under the radar. Namely, web3 is the first and only technology that inherently contains a native asset class. As such, it will always be prone to oversimplification and superficial analysis, a burden that needles, chips, and locomotives never had to bear.

Crypto also possesses a unique property that Gaming, eCommerce, Mixed Reality, and especially AI teams can only dream of – web3 is both a technology and an asset into which investment can be made without any centralized approval. This creates unstoppable entrepreneurship and bottom-up garage innovation, leading us to the first point of the text and the so-called Lindy effect, which states that technologies become harder and harder to get rid of the more they are used.

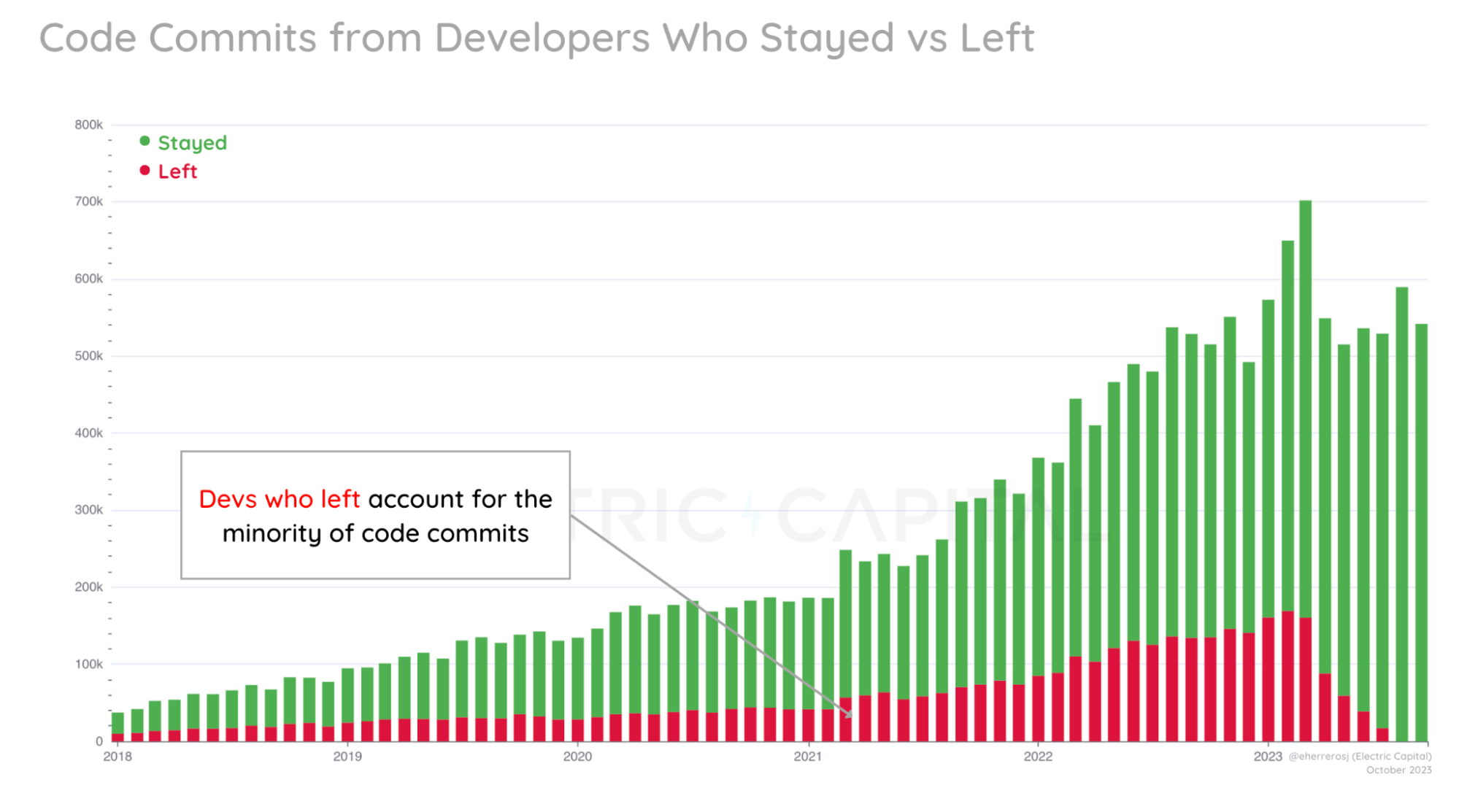

Take, for example, the number of developers and their code commits, which show that there are practically no bulls or bears in the development of web3 technologies. Interestingly, the graph also shows the so-called ‘market cleansing’ that traditionally occurs during a bear cycle, invocations of which you might have heard from older crypto-hardliners.

Now, it’s easy to blame Twitter, newspapers, and television for everything that’s wrong in crypto, but those are mostly lazy discussions. As Ivana Galić Baksa discussed at the Web3 Tales conference – ‘media have their internal educational challenges,’ but it’s not them who invented the ‘wen token’ chant, bombastic ICO baits, and discord-based pump & dump schemes that would not embarrass a late-night World Of Warcraft raid.

In other words, the media can be blamed for a lack of investigative spirit and internal knowledge; however, in my last column, I already wrote that crypto is no longer a playground – and that a lack of self-criticism and education towards the public is a traditional problem of all tech communities, including web3.

The recent CoinTelegraph scam, announcing a BlackRock Bitcoin fund to pump up the price of bitcoin, illustrates this interplay of responsibility between builders and the media. Not to mention the government’s role where SEC’s blatant twitter security bug wiped out 20B USD of Bitcoin market value.

All this brings us back to the title of the text and the big elephant in the crypto room – the grumbling about spot ETFs.

Gen Z and the “Bitcoin funds” frenzy

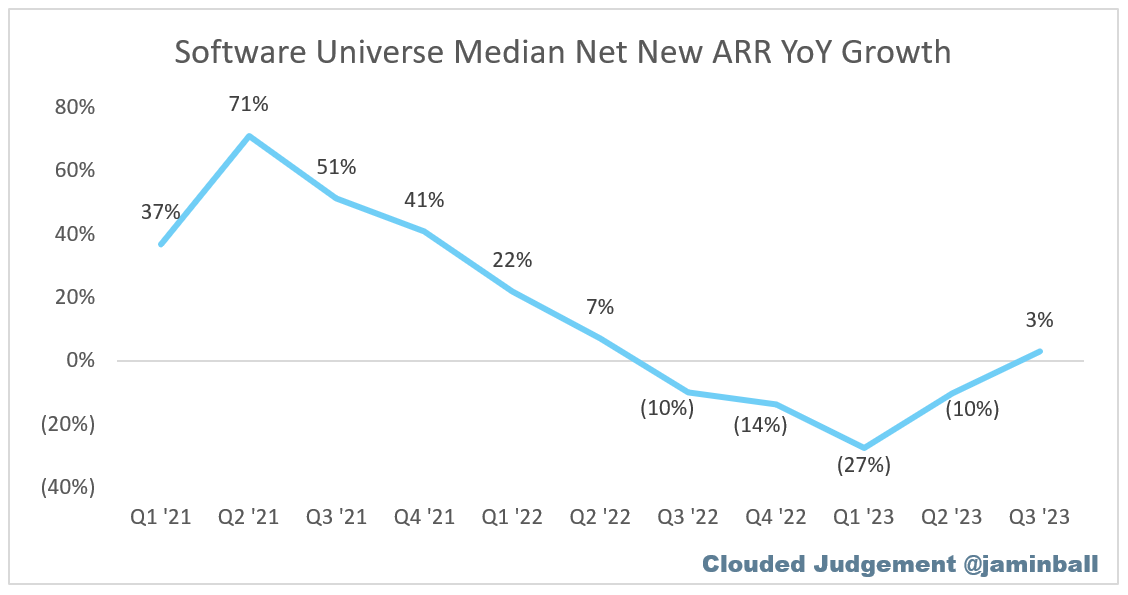

The current bull run calls are driven by a few simultaneous narratives – America, after all, is not heading into a recession, inflation is somewhat calming down, the ‘technological’ NASDAQ (which somewhat correlates with the crypto industry) has revived; and all this affects the software market which is finally rising from the ashes.

Yet the most significant story is the imminent approval of the long-awaited Bitcoin and Ethereum Spot Exchange Traded Funds (ETFs).

A brief summary if you haven’t been following the fund space in recent months – a Spot ETF is a traditional financial (TradFi) product that allows users (retail) and organizations to invest in a commodity without physically possessing it. Word “spot” in this context means that the fund has direct underlying assets placed in some “warehouse” – and in the case of Bitcoin ETFs – this is mostly a Coinbase Custody.

Let’s say you sense a rise in the price of wheat, apples, or, even better, copper… you want to capitalize on this opportunity, but currently, you can’t store two tons of these commodities in your garage. This is where spot ETF instruments come into play, allowing you to fire up your Revolut and invest in that soft metal with just a few clicks.

Banks and funds can package anything into an ETF – oil, grain, bonds, a group of stocks – or even all stocks from a specific industry – like solar or electric vehicles. To be more precise, bankers can package anything that is legally marketable; however, cryptocurrencies in the USA were not part of this milieu. At least, not until recently.

The situation is expected to change during January as the SEC’s approval of 13 Bitcoin-based spot ETFs is currently anticipated. Ethereum, on the other hand, is expected to get its spot funds in the spring of 2024.

Why’s this important for Web3?

Spot ETFs are existing financial ‘infrastructure’ used by banks, exchanges, brokers, and for the U.S. market, important ‘advisory’ services, operating under well-established procedures and regulations.

In simple terms, spot ETFs open up crypto to major investors who, due to their internal, technical, and other reasons, are not allowed, unwilling, or unable to hold any kind of crypto wallet. Just to grasp the scale – these institutions hold about 48 trillion dollars, which at the time of writing is 32 times more valuable than the entire web3 industry.

Galaxy Research cautiously estimated that the Bitcoin ecosystem could experience an influx of at least 14 billion dollars in the first year of these crypto spot funds’ operation – which could increase the price of Bitcoin by up to 74%.

However, everyone knows you have to be careful with reading various articles on the internet; and here’s the obligatory antithesis from the clique that considers spot funds a big nothingburger…

- A Bitcoin spot ETF already exists in Canada and its North Exposure hasn’t brought much success.

- There’s also the point that the announcement of spot ETFs might already be factored into the current price of Bitcoin or Ether.

- A third (debatable) argument is that large institutions can access crypto assets in other ways (like Coinbase Custody, Kraken’s Etana, etc.), so spot funds might not be such a novel tool for them.

- There’s a (likewise debatable) possibility that the SEC might delay the approval of these funds indefinitely.

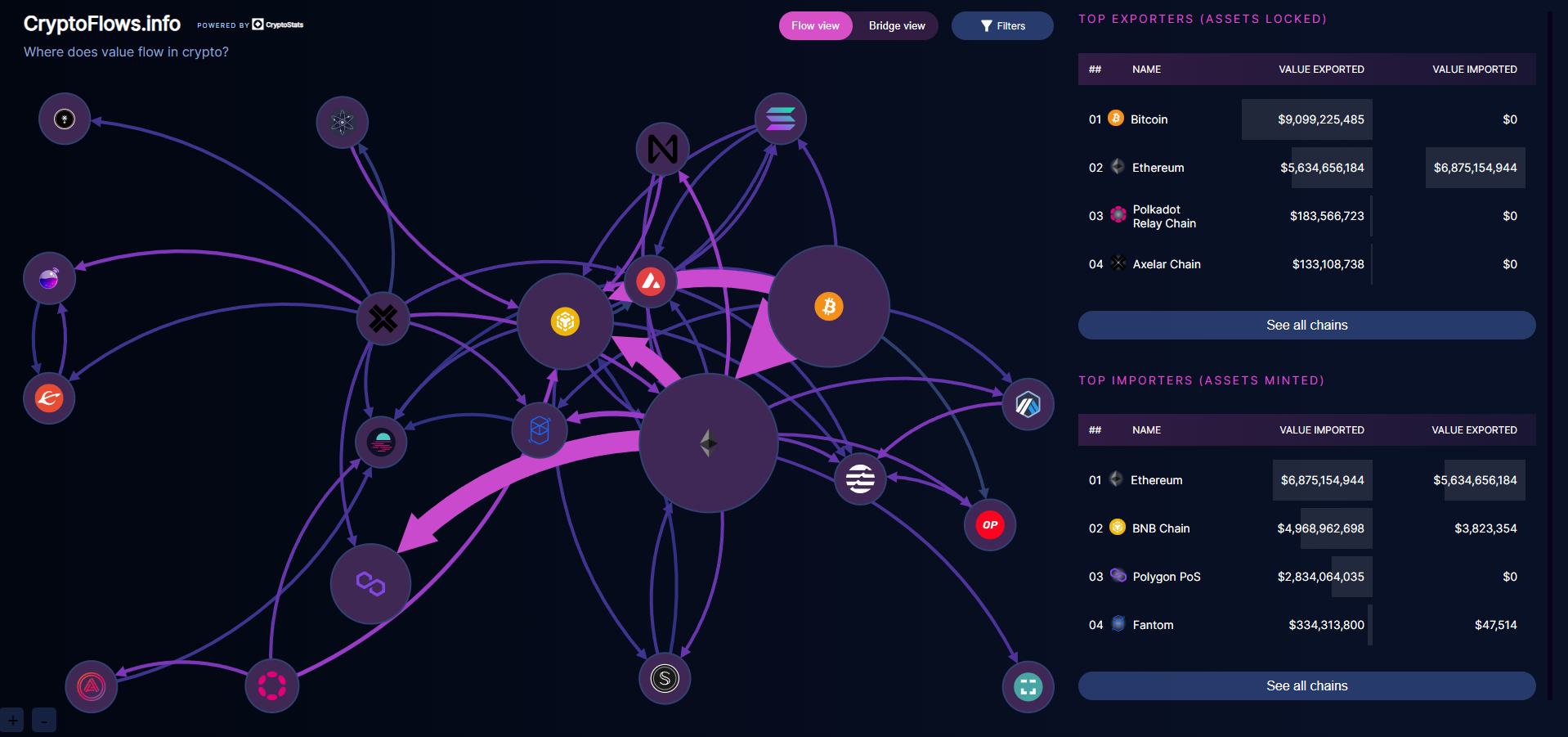

In summary, spot funds still build new bridges and help let the crypto ‘hooves’ through the entire economy; but their launch has two more interesting background stories – stories that are far more significant for web3 than their mere impact on cryptocurrency prices.

Three sleepy kings

The arrival of Fidelity, BlackRock, and other funds is a result of the gradual acceptance of the crypto industry by Wall Street (Lindy effect in play again); but also due to the current reshuffling of the market, where crypto is seen as a ‘hot sauce’ – a class of non-boring asset that ensures better returns with minimal changes to the portfolio.

But the real reason behind funds entering web3 are Generation Z, or rather – their future clients who are already spinning 360 flips over every net banking ad. Currently, a significant wealth migration is happening from boomers to millennials and younger generations, and it’s precisely them that the powerful Larry Fink (BlackRock) wants to court – and then suddenly 😇 proclaims that crypto is a flight to quality. Fink seems to be subscribed to the Grayscale newsletter, which states that 58% of millennials and 54% of the Gen Z population see crypto as the future of finance.

The upside of ETFs and expanding the Web3 reach is that more people will have “skin in the game” and in doing so, will probably want to learn more about the “crypto stuff” – further boosting our own efforts in educating the market. But there’s a catch…

The second story suggests a shift in the structure of crypto investors. BlackRock – along with Vanguard and State Street – are all part of the massive financial triad that, over the past thirty years, has led to a significant passivization of investors.

For the crypto industry, this means that more and more owners of crypto assets will be passive funds and their dormant clients – who couldn’t care less about the native web3 concept that everyone should keep their wallet, actively vote in DAO assemblies, or run a validator or two at home in the pantry.

Although the arrival of ETF instruments boosts the credibility of the crypto ecosystem; the funds themselves will definitely not change the technological foundations, on the contrary, they could even slow down innovative efforts. Read Kotarski’s text on Arhivanalitika describing how the passivization of investors leads to a decline in competitiveness and a lethargy of innovation. And here we come to the second point of the text and the main web3 issue – the lack of widely used applications.

2nd floor pogo dancing

At web3 conferences, it’s mostly architectural debates that resound all around. Whether Solana is opening an embassy on Ethereum; will Bitcoin embrace NFTs, what exactly is the risk with restaking, and what is NEAR’s policy regarding Ethereum… these are just some snippets of the infrastructural dramas, devoid of any real end-user interactivity.

OK, I must be fair and list that stablecoins are slowly becoming what bitcoin and ether (ironically) were meant to be => a medium of digital exchange; NFTs are no longer mentioned just as images but as new eCommerce/Gaming interactivities; and the aforementioned kings are viewing crypto as a long-term Store Of Value.

Some might superficially say that focusing on infrastructure is the easy play of the web3 community and that it’s easier to promise far-reaching technologies that will ‘one day’ knock our socks off, rather than, for example, dealing with applications and the hell of B2C customer support. The real situation (as it usually goes) is a bit more complicated.

The fundamental reason for the crypto ‘infra’ narrative is driven by investors and the real business need to replicate existing cloud infrastructure models (AWS, Azure, Google Cloud) in the web3 world – which have already proven to be a tempting safe bet cash cow, but also as a new form of geopolitical artillery.

Tokenomics, as both a blessing and a curse of the web3 world, goes hand in hand with such a focus on infrastructure. Ana Marija, Antonija, and Mia have already discussed this duotone; and I’m writing a compressed version… Future ‘potential’ tokens ensure better returns on invested VC funds and a plethora of media headlines; but on the other hand, they attract new scammers, airdrop farmers, technological tourists, and copycat projects (rather than new real users) > which, with incessant bull run calls, invokes the same tedious feedback loop of generating infra-only projects.

Ironically, this technological circlejerk – where every web3 team wants to create their version of the new internet – actually promotes 4 market fragmentations:

- On the application side, where developers have to integrate more than 10 login options to cover all user needs.

- On the regulatory side, where governments constantly waver around crypto regulation, pushing new types of digital assets into old, pen-written rules.

- On the user side, where it seems they’ll have to earn a PhD from the ‘Rabbit Hole’ university just to grasp all the crypto rules.

- And on the investor side, where as much as 70% of VC money (7 billion dollars accumulated in the last two years) awaits deployment, i.e., cannot find a product-market fit.”

Crypto is more like hardware

What you typically hear in the corridors is we’re so early and that mass adoption will ‘eventually come’, but Bitcoin has been around for 15 years, smart contracts for 10 years, and blockspace has been gaping empty for more than five years. This raises the question of whether we are still young or if these are eons in the digital industry?

Considering that it took the eCommerce industry 30 years to reach about 20% of the total retail volume; that Apple’s Vision Pro is the result of 60 years of arduous VR development, and that artificial intelligence dragged on for 80 years before it began synthesizing meaningful text – from a safe distance, we can say that web3 is a relatively fresh endeavor – and that many bulls and bears are still ahead of us.

But the real challenge for the crypto community isn’t BlackRock funds, changes in the structure of hodlers, the balkanization of infrastructure, and the described 4 fragmentations – it’s the need to look at the development of infrastructure and applications through a new and different prism where tokenization and the evolution of traditional web blueprints won’t be the first thought.

Because, when you look more closely, the development of irreversible, uncensorable, and composable Web3 applications is closer to the development of hardware or even better, cars, which once they leave the factory have their own ‘life’ – which you can’t just quickly fix in a web2 agile friday-night style 🙄. In other words, the immutable and decentralized nature of the system makes the development of smart contracts and modern tokenomics a much harder and more responsible job than cobbled-together “move fast, break things” applications.

Indeed, one bug can lead to billions of dollars lost – and not just within your application but also all connected players (composability as another duotone). That’s why, on the whole, it seems wiser for our web3 society to listen to Albert Gajšak, rather than to scatter libertarian crypto manifestos.

All of this is already known. Major changes in technological dominance haven’t generally come from a new product doing the “old thing” in a better way – but from processes, platforms, or products that introduce a completely new mindset and rules of the game.

This text, therefore, is not like that clichéd It’s time to build calling out; it’s more of a sigh that we finally move away from toxic bull run distractions and the perpetuation of blind ‘hopium’ narratives that the cryptocurrency market – instead of new applications and fresh thinking – is what determines the value of web3 technology.